Home » Resources » Industry Analyses »

The 2023 U.S. holiday shopping season will likely be more deeply discounted than ever based on our analysis of the recent Amazon Prime Big Deals Day 2023 event—only Amazon’s second October Prime Day sale—and the trends from the Amazon Prime Day in July. Expect large, cross-category promotions ahead, particularly in giftables and seasonal product categories such as Apparel and Toys

Pulling Apart the Promotions Numbers

Below we dig into the categories of promotional particulars most resonant for retailers. These compelling data points are in addition to the ones we offer in our 11-categories analysis of all Amazon Prime Day promotions from 2019-2023.

The deepest Big Deal Days discount went to Home Improvement, followed by Household Supplies, Apparel, Personal Care, and Amazon Brands. The Home Improvement and Household Supplies categories also received the deepest discounts for Prime Day (July ‘23).

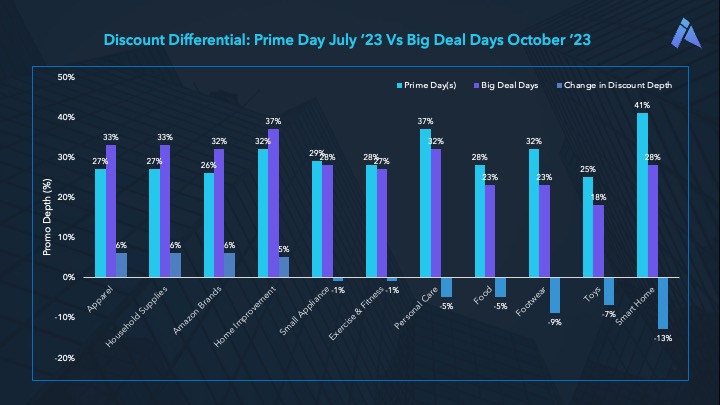

Compared to the 2023 Prime Day event…

- The Big Deal Days categories with the highest jump in promotion depth were Apparel, Household Supplies, and Amazon Brands: They increased an average 21 percent.

- But many other Big Deal Days categories went the other way, dropping significantly in promo depth. Discounts on Footwear, Toys, and Smart Home products, for example, were ~25 percent lower than the summer event.

- Discounts for only a few categories, such as Small Appliance and Exercise & Fitness, held steady.

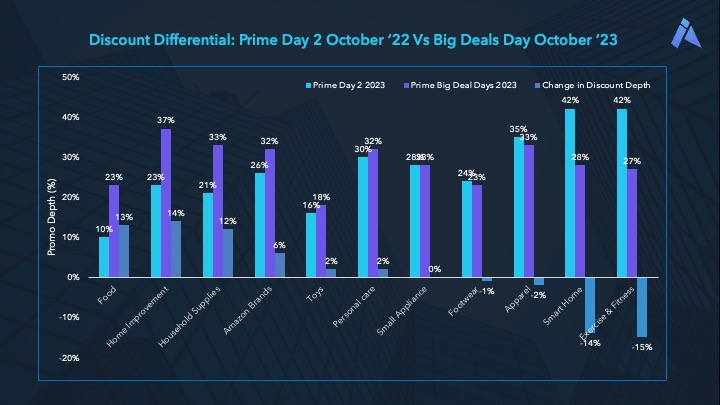

Compared to the 2022 October Prime Day event…

- The Food category took top honors with the greatest year-over-year increase in promo depth by far. Household Supplies and Home Improvement were also big winners (losers?) at 59 percent.

- While most categories saw discounts increase from 2022, Exercise & Fitness and Smart Home saw a ~34 percent YoY reduction.

- Discounts in a few categories, such as Personal Care, Small Appliance, and Footwear, stayed more-or-less the same.

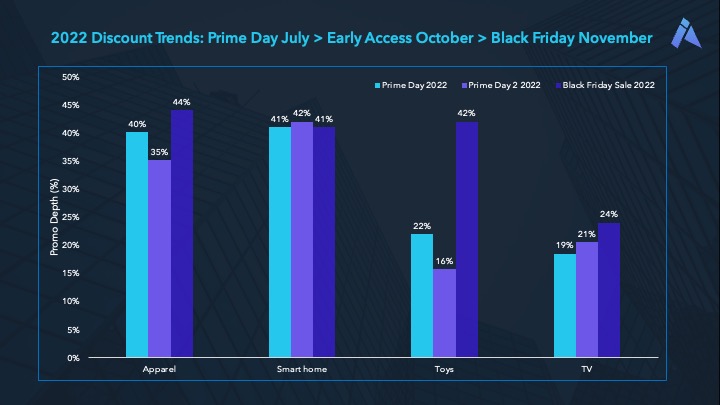

In 2022, we saw …

- Black Friday discounts were deeper than both Prime Day (July) and Prime Big Deal Days (October) events.

- Smart Home and TV category promotional depth changed little across Prime Day and Black Friday events.

- For Black Friday, the Toys category received the steepest increase in promo depth compared to either Prime Day event.

Amazon Prime Big Deal Days and the 2023 Holiday Season

Our analysis strongly suggests that, despite cooling inflation, a still-rosy employment picture, and the U.S. Federal Reserve’s fabled “soft landing” for the economy nearly in hand, consumers will continue focusing their spending on nondiscretionary items—and retailers will continue targeting those items for discounts.

Of course, there’s still a lot yet to process this year. Variables and unknowns include U.S. politics (looking especially chaotic nowadays), violent conflicts elsewhere (looking especially troubling nowadays), interest rates (going up?), inflation (coming down?), and what have you.

As conditions subtly shift or utterly transform, retailers must be prepared to make quick, tactical changes to their pricing and promotions strategy. That’s what we’re here for.

Choose the Impact Analytics Pricing War Room for the Holidays

Do pricing and promotions right and you’ll maximize your profitability this holiday season.

The Impact Analytics Pricing War Room offers five customized pricing services and a dedicated team to run things. Take advantage of our expertise, hands-on tactical support, and 20,000+ predictive AI models, harnessing the maelstrom of internal and external signals to power a successful pricing strategy.

Check out the Impact Analytics Pricing War Room.

References: 1Amazon | 2Adobe | 3Numerator

Driving ROI through

AI Powered Insights

We are led by a team with deep industry expertise . We believe in “Better decisions with AI” as the center of our products and philosophy, and leveraging this to empower your organization