Black Friday Promotion Analysis:

Holiday shopping was expected to stay flat or increase only marginally year over year thanks to stubborn (though much diminished) inflation and higher interest rates. Retailers have traditionally responded to similar conditions with deep discounts. What did they do for this year’s Black Friday sales events?

Home » Resources » Industry Analyses »

Black Friday Promotion Depth Trends 2021-2023

Average promotion depth for the Black Friday 2023 sales event was 35 percent—flat compared to last year.

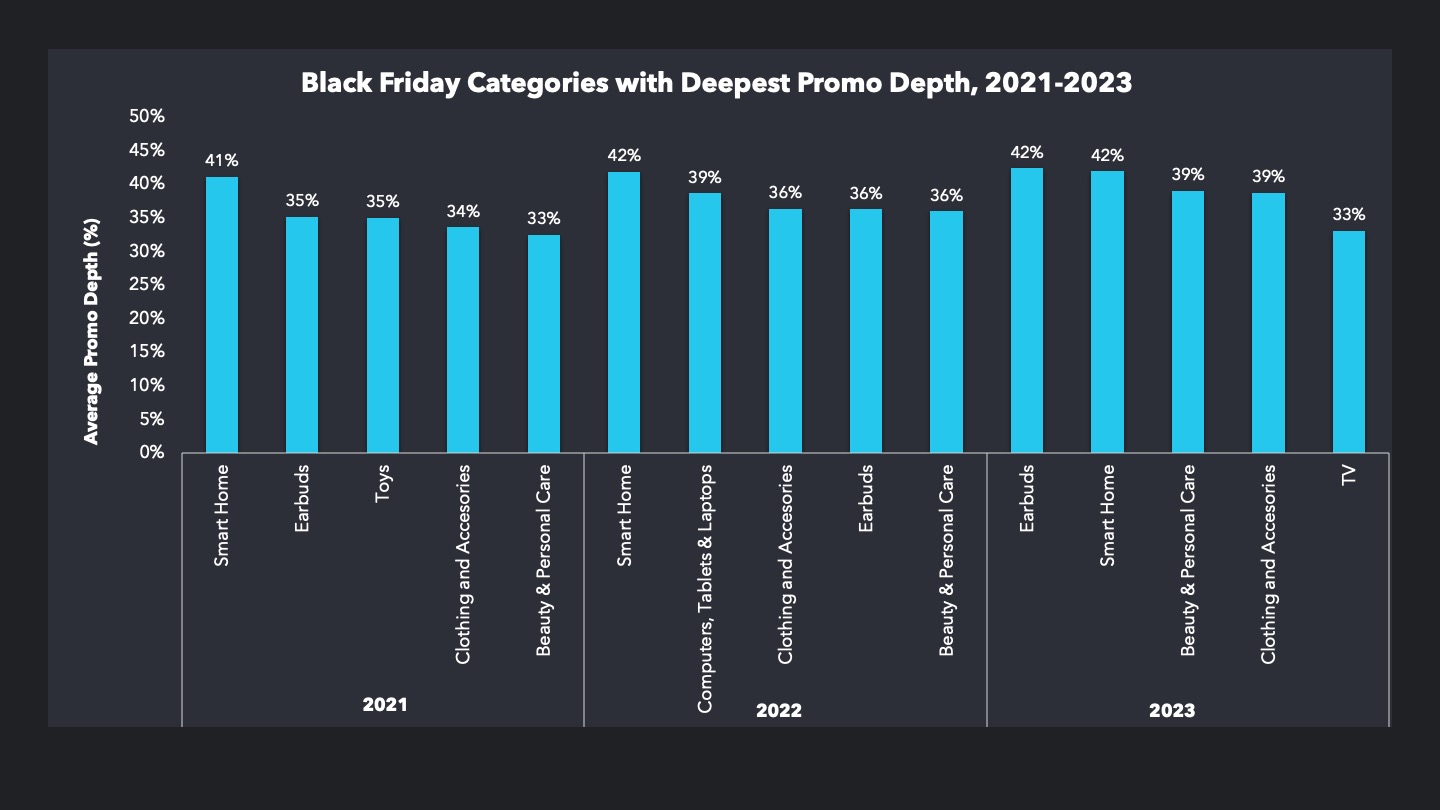

Smart Home, Earbuds, Clothing and Accessories, and Beauty & Personal Care products have stayed consistently among the top five most discounted categories year after year.

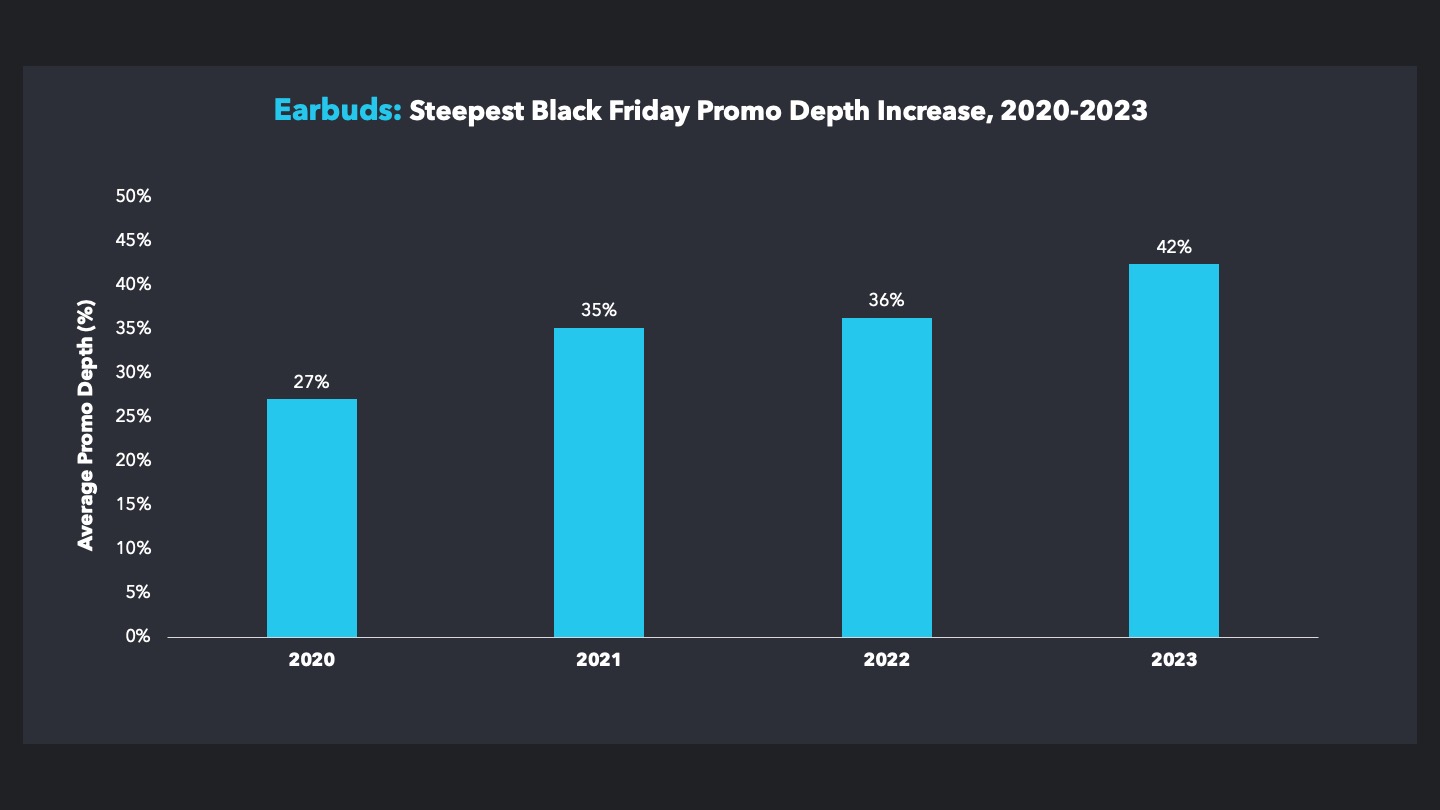

Dominance of Technology-Driven Categories: A slew of innovative, technologically enhanced products enter the market every year, and consumers’ love for the latest and greatest gadgetry ensures Smart Home and Earbuds categories are always heavily discounted to grab shopper attention.

How Did Black Friday 2023 Compare to 2022?

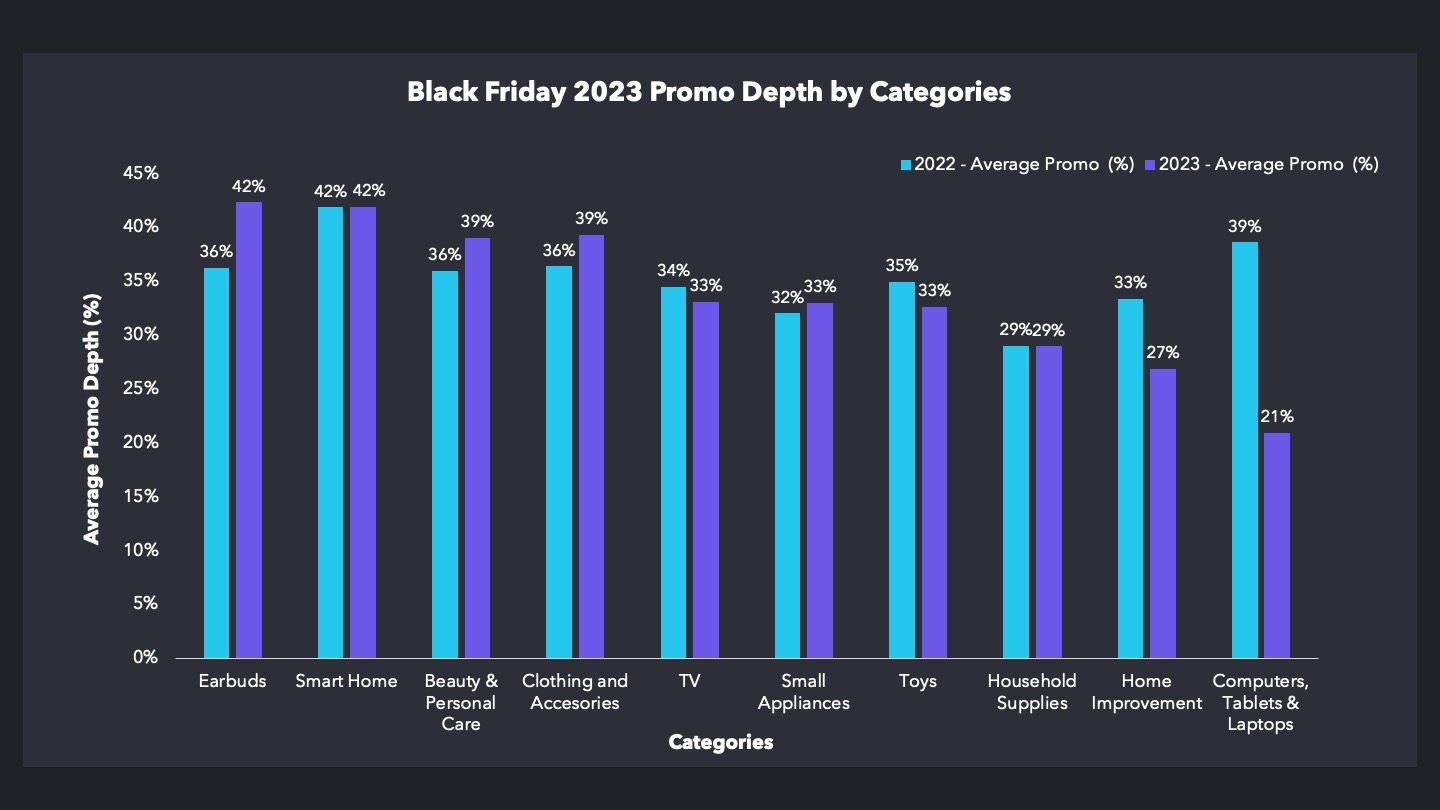

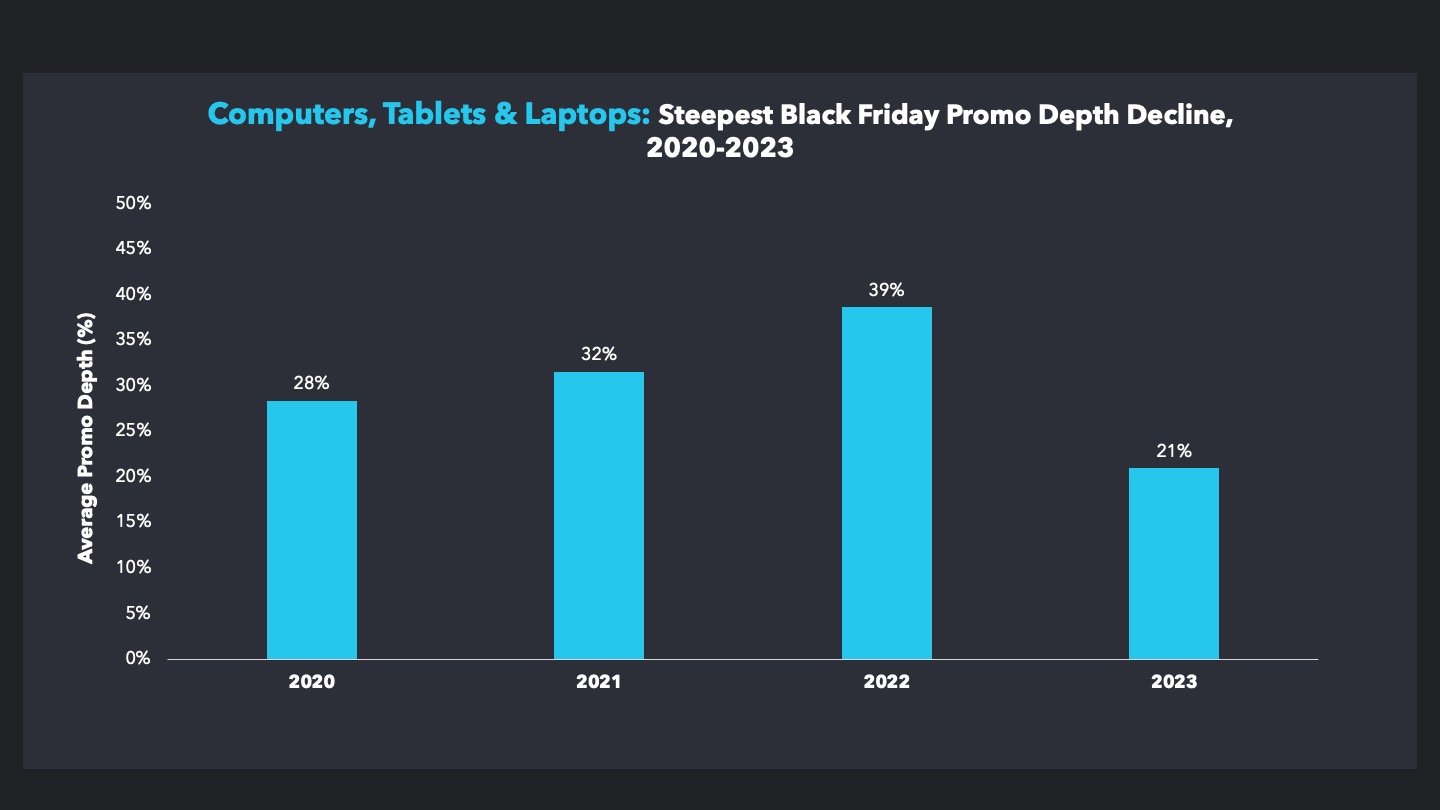

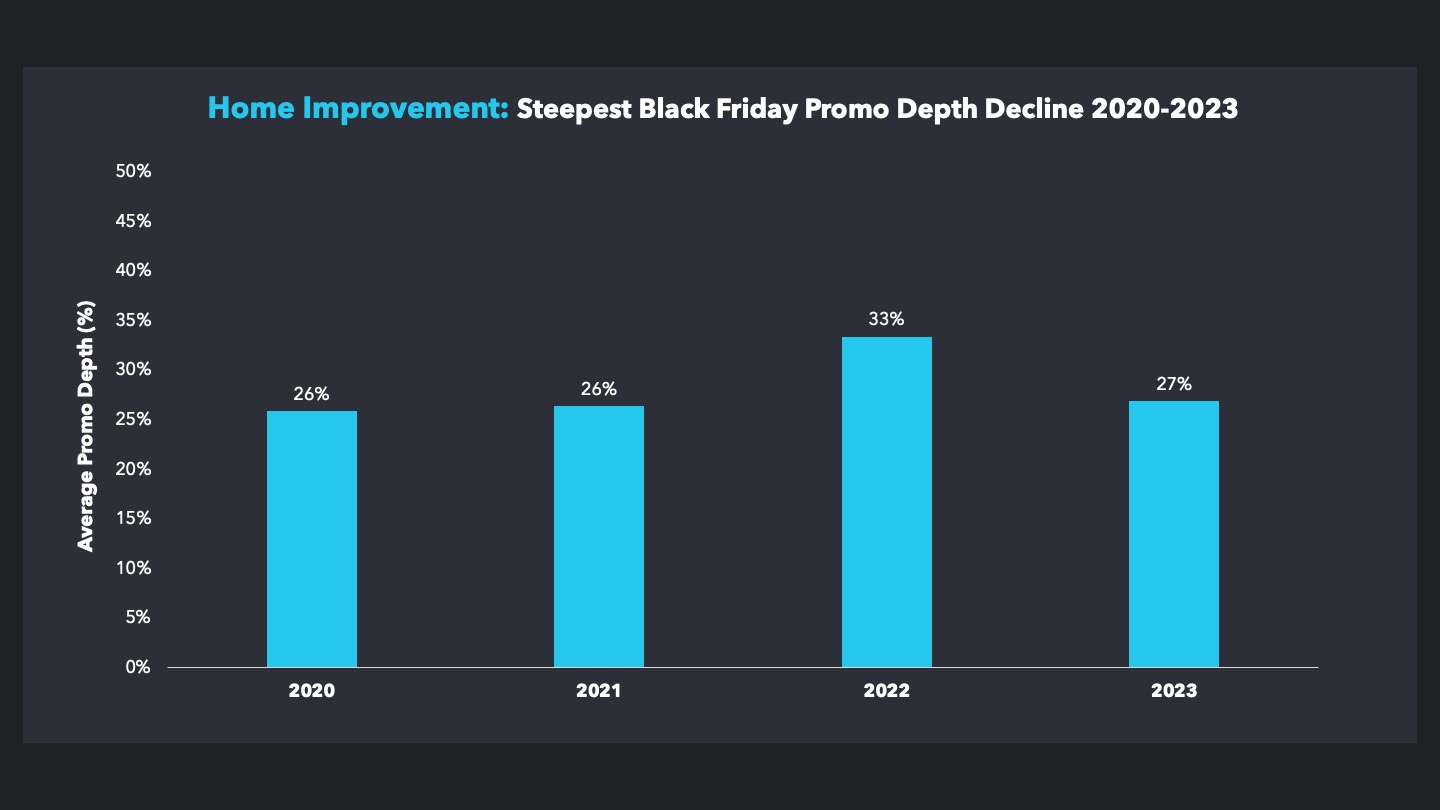

Black Friday 2023 discount depth changed little compared to last year The exceptions were Earbuds (up 6%), Home Improvement (down 6%), and Computers, Tablets & Laptops (down 18%). The steep drop in PC promo depth appears to be a regression to the mean as the category was discounted unusually heavily in 2022.

The Black Friday 2023 categories with the deepest promotions included the four perennial leaders:

Earbuds—This category’s average promo depth of 42 percent (up 6% from 2022) ties it with Smart Home for the most deeply discounted.

Smart Home—Smart Home also sported a promo depth of 42 percent, unchanged from last year.

Beauty & Personal Care—Beauty & Personal Care promotion depth in 2023 was 39 percent, a slight increase (3%) over last year.

Clothing and Accessories—Same as Beauty & Personal Care: 39 percent in 2023, a slight increase (3%) over last year.

Categories with Steepest YoY Promo Depth Increase

The Earbuds category has seen a consistent increase in promo depth during Black Friday, highlighting the popularity of wireless audio technology and the diverse price points available for consumers with different budgets.

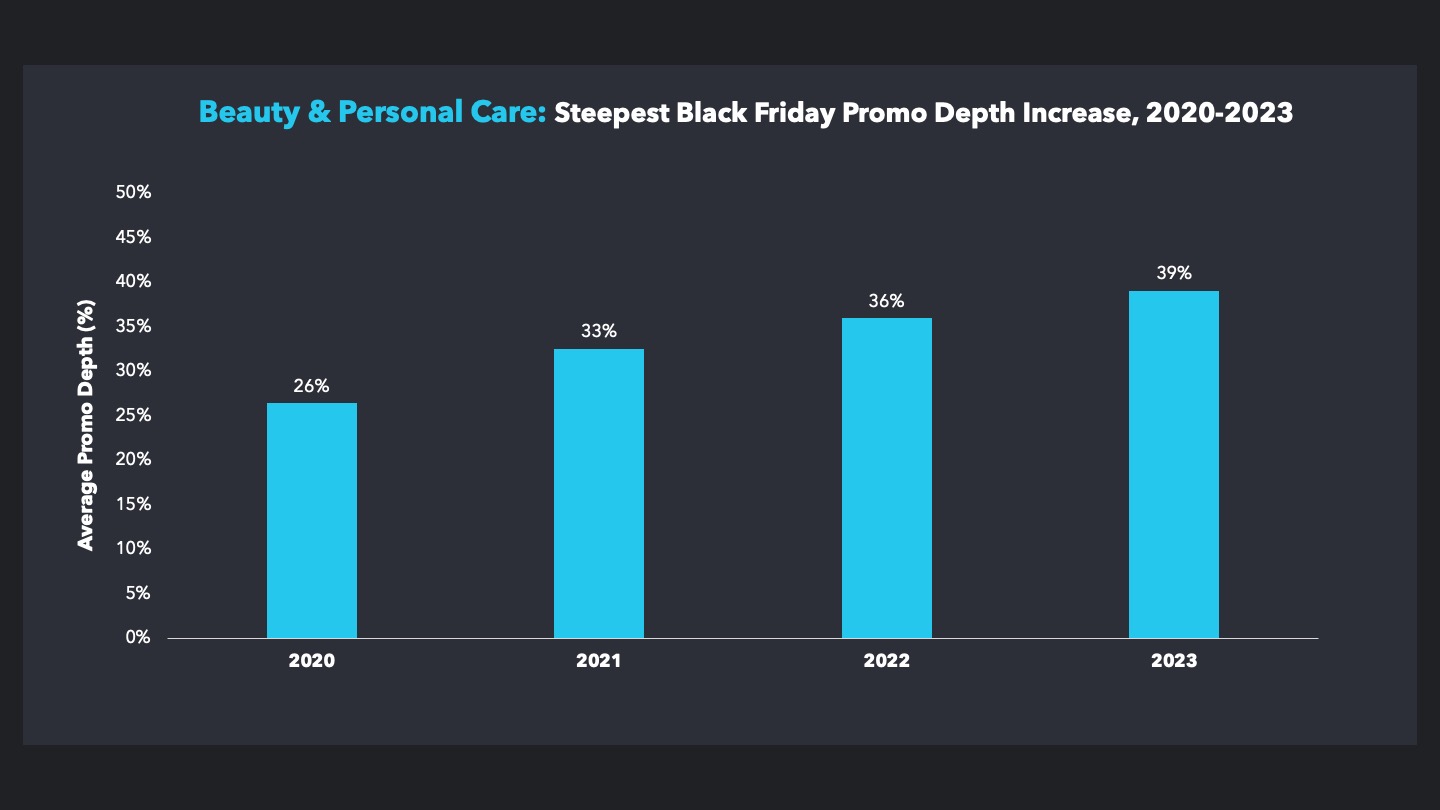

Much like Earbuds, the Beauty & Personal Care category has consistently grown its promotion depth, highlighting shopper interest in self-care and grooming for themselves during the holidays as well as for gifting.

Categories with Steepest YoY Promo Depth Decline

The Computers, Tablets & Laptops category registered the most dramatic YoY promo depth decline, down 17 percent from its 2022 high of 39 percent.

Home Improvement, the category with the biggest increase in average promo depth during the 2023 Amazon Prime Big Deals Day sale, saw its depth of promotion dip 7 percent. (How the mighty have fallen!) The latest updates indicate home repair tools underperformed, which may be attributable to the lower promotions.

How Retailers Planned Their Black Friday Sales Events

Virtually all major retailers announced pre-holiday event sales in October. Amazon announced Big Deals Day, Walmart announced Walmart Deals, and Target and Best Buy made similar announcements. Retailers employed different strategies during the Black Friday sales event.

Big Box Retailers—Most big box retailers started their Black Friday sales on Wednesday, November 22 and ran them for four days. A few retailers such as Home Depot and Kroger held their sales for seven days.

Fashion (Apparel, Footwear, and Beauty)—Fashion retailers planned sales to start as early as November 15 and continue as late as November 27. Most, though, limited their sales to seven days.

Electronics and Appliances—Many Electronics retailers planned sales to run an average of 10 days until November 30. Apple and Samsung, however, limited their Cyber Monday sales event to just four days (November 24-27).

Conclusion and Guidance

Overall, retailers have held their Black Friday discounting steady, taking a wait-and-see approach before going deep on discounting further into the holiday shopping season.

Even as consumers continue to open their wallets, they express pessimism about the economic outlook, which could lead to slower sales growth. Accordingly, retailers will have to chalk out the right promotion and markdown strategy to liquidate their inventory profitably this holiday season.

Driving ROI through

AI Powered Insights

We are led by a team with deep industry expertise . We believe in “Better decisions with AI” as the center of our products and philosophy, and leveraging this to empower your organization