“Times and conditions change so rapidly that we must keep our aim constantly focused on the future.”

— Walt Disney

Come Jan 2025, an old word will become new again in the headlines: Tariffs.

By planning for these adjustments in advance, retailers can strategically position themselves to balance price competitiveness with profitability—staying agile and resilient as new tariff policies unfold.

One of the proposals presented during the election is a tariff across the board—and a higher tariff rate across products from China. Universal tariff proposals could have pricing implications on multiple categories, including clothing, toys, furniture, household appliances, footwear, and travel goods, according to a new report from the National Retail Federation.

How Do Tariffs Impact Retail Operations?

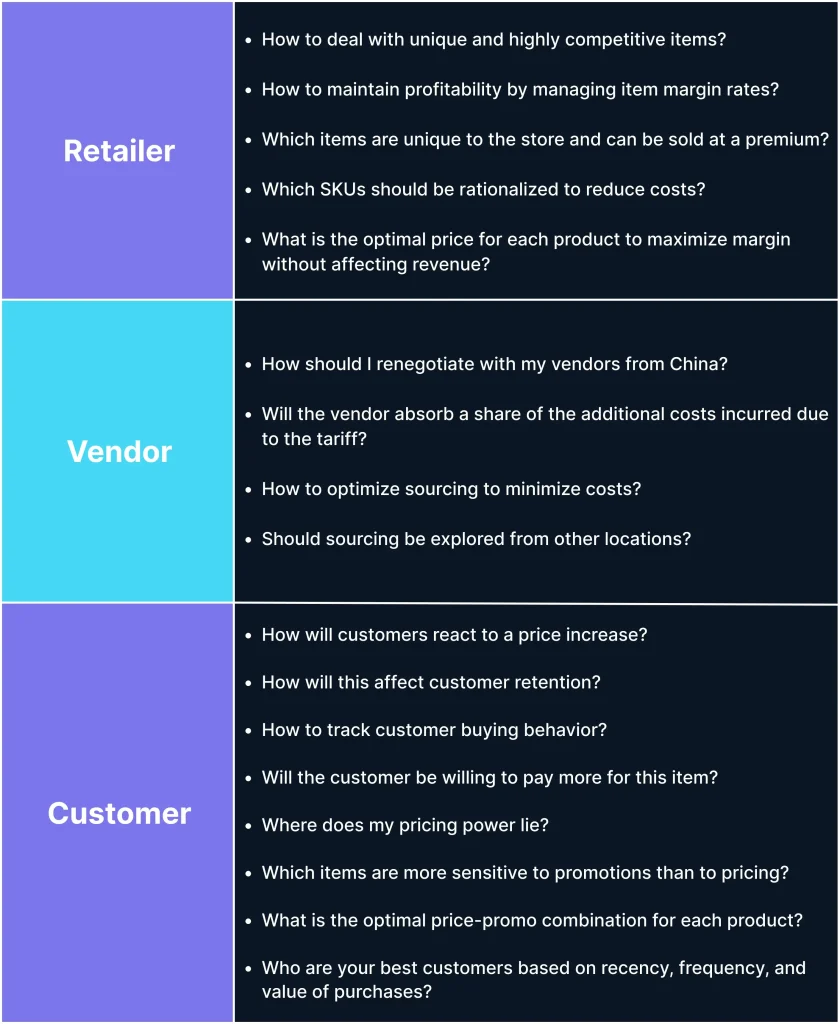

The potential impact of these price variables warrants a strategy revisit. Devising these strategies means answering multiple questions across key business domains:

Pricing Implications of Increased Tariffs

Tariff increases can lead to direct cost increases for retailers that rely on imported goods. This can affect pricing in the following ways:

- Cost-Pass-Through: Retailers may choose to pass the additional costs (partially/fully) directly onto consumers, increasing shelf prices. This strategy can maintain margins but may reduce demand if consumers resist higher prices.

- Margin Compression: In categories where price elasticity is high, retailers might absorb the increased costs to maintain price competitiveness, which can reduce profit margins.

- Price Tiering Adjustments: Retailers might reconsider their price tiers and restructure assortments, especially in discretionary categories like luxury goods, where the price points are already high.

Why is AI Critical in Managing Tariffs While Maintaining Profitability?

They need to leverage data and AI to categorize SKUs into strategic buckets. Experts at Impact Analytics have defined a playbook to help navigate tariffs, involving a mix of strategies- crunching terabytes of POS data, scaling it into all possible hypothetical scenarios, and applying advanced AI and machine learning models. Where the rubber meets the road, the result of this exercise will be definitive answers, at the SKU level as to where to preserve the margin, pass on the cost, and adjust as needed. Given the volatility of tariffs, this exercise should be repeated periodically, and then AI can take care of the rest.

1. Factors to Consider in Pricing Adjustments

For effective pricing decisions, retailers must evaluate several key factors:

- Demand Elasticity: How sensitive is demand to price changes in each category? For instance, consumers may be more price-sensitive in categories like groceries or basic apparel than in luxury items.

- Key Value Items (KVIs): KVIs are products with high price sensitivity and visibility that consumers often use to judge a retailer’s price competitiveness. Retailers must decide whether to absorb tariff costs on KVIs to maintain a competitive edge.

- Competitive Landscape: Retailers need to monitor competitors’ responses to tariff increases. If competitors absorb costs while maintaining low prices, matching price hikes could hurt market share.

- Consumer Perception and Loyalty: Price increases on essential items may erode consumer trust and loyalty, especially if other retailers choose not to pass on the cost increase.

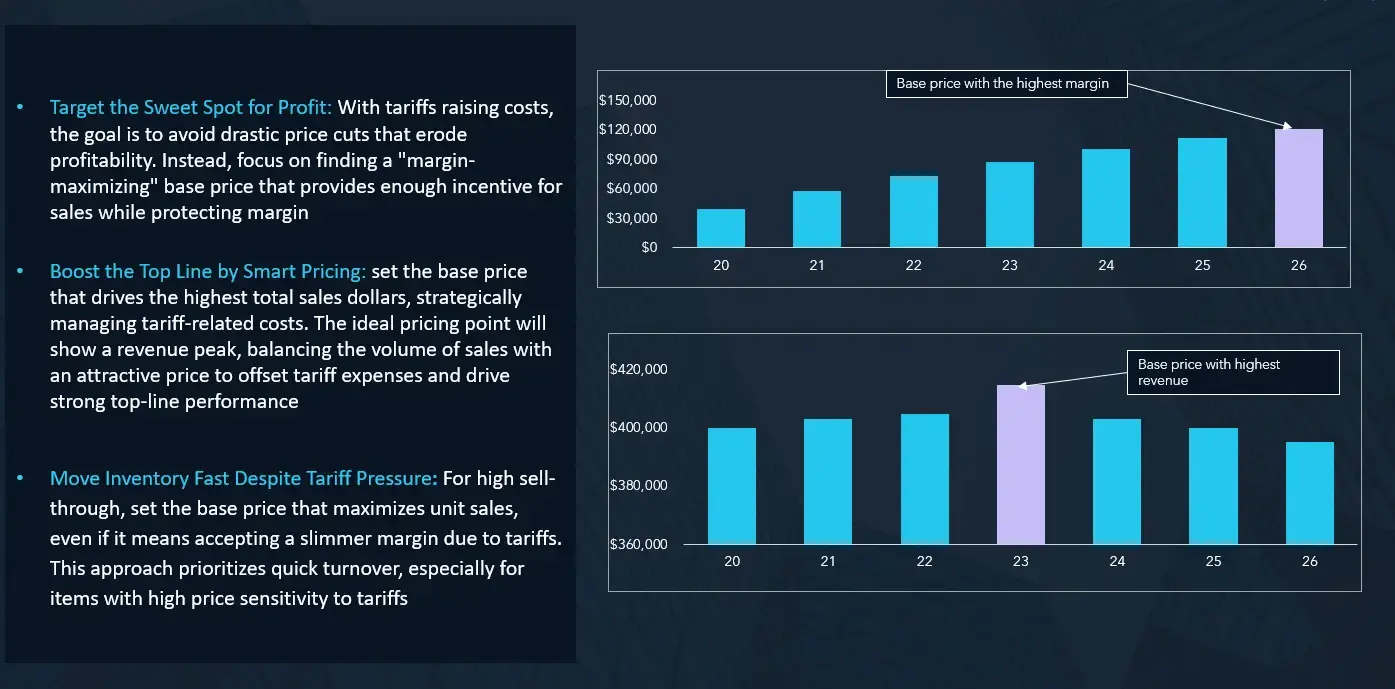

Illustration of how different pricing strategies can be applied:

2. Product-Specific Considerations

Each product category is affected differently by tariff increases, depending on consumer perception, price sensitivity, and the retailer’s strategic priorities.

Luxury Goods

- Impact: Luxury items, including high-end fashion and electronics, often have less price elasticity. Consumers purchasing luxury goods are generally more resilient to price increases, allowing retailers to pass on the cost without significantly impacting demand.

- Strategy: Retailers could increase prices proportionally with the cost rise. For instance, a luxury handbag previously priced at $1,000 might increase to $1,100 if a 10% tariff is added. Margin preservation is usually prioritized in this segment.

Apparel

- Impact: Apparel is often price-sensitive, with many low- to mid-range brands facing competition. A small price increase can result in a noticeable drop in demand.

- Strategy: Retailers could selectively pass on costs in less price-sensitive segments, such as premium lines while absorbing the increase in basics like T-shirts or jeans. A mix of cost-sharing and careful promotional strategies may help maintain demand.

Electronics

- Impact: Electronics face strong competition, with consumers highly price-aware and likely to shop around for deals.

- Strategy: Retailers might need to partially absorb the increased tariff costs, particularly on popular models, or negotiate with suppliers for shared cost mitigation. Promotions or bundling might help justify slight price increases without deterring consumers.

Essential Goods (e.g., Groceries)

- Impact: Essentials are highly elastic and directly influence a retailer’s image. Price increases on KVIs like milk or bread can quickly impact consumer perception.

- Strategy: For essential goods, retailers might avoid passing on tariffs to maintain competitiveness and loyalty. Instead, they could manage costs by reducing margins slightly or re-evaluating supply chain efficiencies.

3. Adaptive Strategies: Focus on KVIs

For categories containing KVIs, the following strategies help mitigate the effects of increased tariffs:

- Selective Cost Absorption: Absorb the added costs on high-profile KVIs, such as certain fresh produce items or staple groceries, to maintain competitive price points.

- Cross-Category Margin Balancing: Increase prices on less sensitive items within the same category to offset the losses from KVIs. For instance, a retailer may keep prices stable on KVIs like milk and bread while slightly increasing prices on premium cheeses.

- Supply Chain Negotiations: Negotiate with suppliers for shared cost burdens or explore alternative sourcing options to mitigate tariff effects.

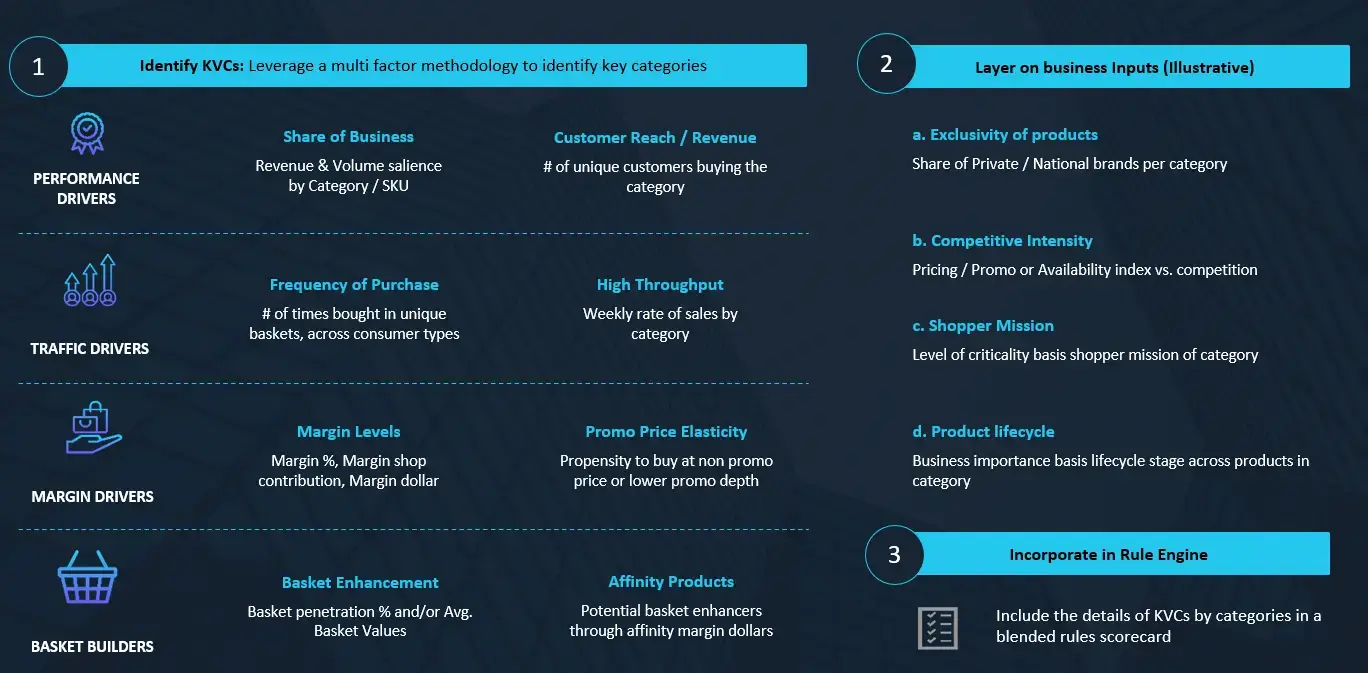

How a thorough KVC/KVI Analysis can be done:

Illustrative Scenario of Two Different Items Based on Elasticity

Example 1: White T-Shirt (Inelastic Item)

Basic white T-shirts are a staple in any wardrobe and tend to be inelastic, meaning price changes have minimal effect on demand.

- Original Cost: $40

- Retail Price Before Tariff: $100

- Cost with 10% Tariff: $44

If a retailer passes the full increase to customers, the shirt’s price might go up to $105. However, given that this is a core item, most shoppers will accept a small price increase without much drop in demand. The retailer could also choose to keep the price at $100 and absorb the $4 increase, keeping it attractive to consumers and maintaining volume.

Key Takeaway: For core products like white T-shirts, even a minor price hike likely won’t deter buyers, so retailers have the flexibility to either absorb the cost or pass it on with little impact on sales.

Example 2: Trendy Sunglasses (Elastic Item)

Seasonal, trendy items like sunglasses are much more price-sensitive. Consumers are often willing to switch to a cheaper alternative or wait for a sale.

- Original Cost: $15

- Retail Price Before Tariff: $30

- Cost with 10% Tariff: $16.50

If the retailer raises the price to $33 to cover the tariff, it risks losing customers who might view the higher price as less justifiable for a non-essential item. A smarter approach might be a smaller increase, say to $31, or keeping the price at $30 but absorbing the cost increase to preserve demand.

Key Takeaway: For elastic items like trendy sunglasses, even a small price hike can drive customers away. Retailers often have to absorb some of the cost increase or use discounts and promotions to maintain demand.

Preparing for What Comes Next

Advanced analytics and AI-powered pricing optimization are critical to navigating the complexities of tariff-induced cost pressures. Our AI-native solutions leverage granular SKU-level elasticity analysis and robust forecasting, allowing retailers to simulate various pricing scenarios and predict the impact of tariff spikes on consumer demand. With dynamic pricing adjustment recommendations, we ensure that retailers can respond swiftly to shifts in cost without compromising margin stability.

Our approach integrates key factors like seasonality, competitive behavior, day-to-day trends, and KVI analysis to maintain competitiveness across core and discretionary categories. With automated exception-based workflows and continuous cadence refinement, our solutions empower retailers to implement precise pricing actions that protect profitability. Through a data-driven strategy, we enable agility and resilience, equipping retailers to make informed pricing decisions as new tariff policies unfold.