Tariffs are making a comeback, and they’re about to shake up the retail industry again. For businesses in apparel, footwear, furniture, and consumer goods, this isn’t just another regulatory hurdle—it’s a potential game-changer. The stakes? Higher costs, disrupted supply chains, and tougher competition. If the trade war of 2018–2019 taught us anything, it’s this: tariffs don’t just impact global politics—they hit your bottom line, your customers, and your strategy.

Think back to that era. Import prices soared, consumer wallets tightened, and retailers scrambled to adapt. Now, as a new wave of tariffs looms, it’s critical to learn from those missteps. Why did some businesses weather the storm better than others? And more importantly, how can you position yourself to navigate what might be an even tougher challenge ahead?

This isn’t a time for panic; it’s a time for preparation. By understanding where past theories went wrong and what practical strategies worked, you can minimize disruptions and even find opportunities amid the chaos. Let’s break down lessons from the past, dissect why this tariff era could be worse, and explore actionable strategies to keep your business resilient and competitive.

Are you ready to face the tariff era head-on? Continue reading.

Lessons From the 2018–2019 U.S.-China Trade War

The 2018–2019 trade war between the U.S. and China serves as a valuable case study. Over $350 billion worth of Chinese imports faced tariffs, causing a ripple effect across industries. For retailers, this period left long-lasting scars, as import prices skyrocketed and consumer spending patterns shifted.

Most of the Tariffs Were Passed to Customers—In the Short-Term

One of the most striking outcomes of the trade war was the near-total pass-through of tariffs to consumers in the short term. While this went relatively unnoticed in 2018, given the current economic environment, this is very unlikely this time around.

According to the National Bureau of Economic Research (NBER) Working Paper No. 26610, import prices increased nearly one-to-one with tariffs in the initial months following their imposition. Retailers struggled to negotiate new contracts or pivot supply chains immediately, leaving them to absorb costs temporarily before passing them on to consumers.

- Furniture: The 25% tariff on Chinese furniture imports drove costs significantly higher. Import volumes dropped, and profitability for retailers suffered as businesses struggled to renegotiate terms with suppliers. Eventually, these higher costs were passed on to consumers, reducing demand.

- Apparel and Footwear: In 2018, 34% of U.S. apparel imports and 53% of footwear imports came from China. Tariffs on these goods led to sharp price hikes, directly impacting demand for price-sensitive items. However, in the longer term, many retailers managed to secure better vendor agreements, easing some of the burden.

Economic Costs to Households

For the average U.S. household, the short-term financial toll of tariffs was substantial. According to the Congressional Budget Office, households paid an additional $1,277 annually due to tariff-related price increases. This burden was exacerbated during the first 12 months, as retailers and suppliers navigated hard negotiations and restructuring. For many families, this translated into difficult decisions, especially for essential but price-sensitive goods.

Sector-Specific Price Impacts

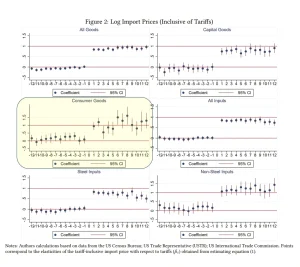

The chart “Log Import Prices (Inclusive of Tariffs)” provides a visual representation of the short-term challenges:

- Consumer Goods: Elasticity coefficients quickly climbed to 1.0, signaling that nearly all tariff costs were passed to buyers during the early months.

- Furniture: Tariffs caused a steep increase in import prices, leading to significant short-term cost burdens before supply chain adjustments stabilized the situation.

- Apparel and Footwear: With heavy reliance on Chinese imports, these sectors felt immediate impacts, forcing retailers to scramble for alternative sourcing and renegotiated contracts.

The attached Figure: Log Import Prices (Inclusive of Tariffs) tells a compelling story of how tariffs affected pricing across sectors.

Note: This chart illustrates how tariffs impacted import prices across various categories over time. The x-axis represents months relative to the imposition of tariffs (0 = tariff implementation). A coefficient of 1.0 on the y-axis indicates that the full tariff cost was passed to buyers.

Note: This chart illustrates how tariffs impacted import prices across various categories over time. The x-axis represents months relative to the imposition of tariffs (0 = tariff implementation). A coefficient of 1.0 on the y-axis indicates that the full tariff cost was passed to buyers.

Where Economic Theories on Tariffs Failed

The application of traditional economic theories during the 2018–2019 tariff era highlighted significant shortcomings. These failures provide valuable lessons for navigating the current situation:

1. Exporter Absorption Misconception

Economic models assumed that exporters would absorb a portion of tariff costs to remain competitive in the U.S. market. However, data from the NBER showed that foreign exporters absorbed less than 10% of these costs, particularly in the first 12 months.

- Initially, U.S. importers bore the brunt of the tariffs, passing costs on to consumers. Over time, hard negotiations with suppliers helped shift some of these costs back to exporters, but the process was slow and uneven across sectors.

2. Ignoring Supply Chain Realities

Economic models often overlook the complexities of modern supply chains:

- High Dependency: Many U.S. retailers relied heavily on Chinese manufacturing and lacked immediate alternatives.

- Costly Transitions: Transitioning to other suppliers—like Vietnam or Mexico—incurred high costs, delays, and inconsistent product quality.

- Time Constraints: Supply chain shifts took months, leaving retailers exposed to high costs during the short term.

3. Misjudging Price Elasticity

Some theoretical models also underestimated demand elasticity in certain retail sectors. For instance:

- Inelastic Goods: Essentials such as basic apparel, and household necessities (e.g., cleaning products, and supplies) experienced minimal demand changes despite price increases.

- Elastic Goods: Categories like fashion apparel and electronics saw sharper revenue declines due to higher price sensitivity among consumers.

These misjudgments highlight the importance of sector-specific strategies rather than broad economic assumptions.

4. Oversimplified Consumer Behavior

Economic theories often treat consumers as rational actors. In reality, consumer behavior is far more nuanced. For example, instead of substituting imported goods for domestic alternatives, many consumers reduced overall spending, amplifying revenue losses for retailers.

Panic buying and shifts in consumer priorities created additional challenges for sectors reliant on discretionary spending. By recognizing these failures, retailers can adopt more practical approaches rooted in real-world complexities, ensuring better preparedness for future tariff challenges.

Why This Time Could Be Worse

The current economic and geopolitical environment makes the return of tariffs potentially more disruptive than in previous years. Key factors amplifying the risks include:

1. Fragile Global Supply Chains

The pandemic exposed significant vulnerabilities in global supply chains. Manufacturing hubs such as Vietnam and India once considered alternatives to China, are still recovering from disruptions. Adding tariffs to this equation could lead to severe bottlenecks, delayed shipments, and increased costs.

2. Persistent Inflation

While inflation has moderated, it remains a critical issue. Higher tariffs on consumer goods could reignite inflationary pressures, particularly in price-sensitive categories such as groceries and apparel. This could further erode disposable income and curtail spending.

3. Rising Consumer Debt

Consumers are already stretched thin with rising credit card balances and higher interest rates. Adding tariff-induced price hikes could reduce demand across discretionary categories, such as electronics and home goods.

4. Geopolitical Instability

Tariffs are no longer confined to U.S.-China relations. Trade tensions with allies such as Canada, Mexico, and the European Union could escalate, further complicating global trade. This increased uncertainty may dissuade retailers from making long-term investments in alternative sourcing.

The convergence of these factors means that this tariff era could result in deeper and more sustained impacts. Retailers must act decisively, leveraging insights from past experiences while adapting to new economic realities.

Scenario Predictions for Retailers

The resurgence of tariffs will impact retailers differently depending on their strategies and market positioning. Here are the potential scenarios:

1. Minimal Impact

Retailers who proactively diversify supply chains, optimize pricing strategies, and leverage predictive analytics may experience only marginal disruptions. Strong consumer loyalty could further cushion the blow.

2. Moderate Impact

Retailers reliant on imported goods may face profit compression as tariffs increase input costs. Strategic pricing adjustments and targeted promotions could mitigate some revenue loss.

3. Severe Impact

Retailers heavily dependent on discretionary spending could see steep revenue declines. Inflationary pressures combined with weakened consumer confidence may lead to widespread inventory challenges and demand shocks.

These scenarios underscore the importance of preparedness. Retailers must adopt forward-looking strategies to minimize risks and safeguard profitability.

How Retailers Can Navigate the Tariff Era

Navigating the complexities of tariffs requires both immediate action and long-term planning. Here’s how retailers can stay resilient:

Short-Term Strategies

- Dynamic Pricing Models

Analyze price elasticity at SKU and category levels to determine optimal price points. Strategic price increases on inelastic goods can protect margins, while discounts on elastic items can sustain demand. - Promotional Tactics

Promotions and bundling strategies can offset higher prices and maintain customer engagement. Targeted discounts on high-demand products can help clear inventory without eroding brand value. - Supplier Negotiations

Engage suppliers to share tariff burdens. This might include securing temporary discounts, renegotiating contracts, or diversifying sourcing agreements. - Inventory Optimization

Focus on high-margin categories and reduce stock levels for items with low price elasticity. Implementing real-time inventory tracking ensures efficient resource allocation.

Long-Term Strategies

- Diversify Supply Chains

Reducing dependence on a single market, such as China, is critical. Nearshoring to countries like Mexico or reshoring certain production lines can mitigate risks and reduce logistical costs. - Invest in Predictive Analytics

Leverage advanced analytics to forecast demand shifts and evaluate the long-term impact of tariffs. Predictive tools can help retailers fine-tune pricing and inventory strategies dynamically. - Enhance Customer Loyalty Programs

Loyal customers are less price-sensitive. Personalized loyalty programs, exclusive rewards, and tailored offers can mitigate the impact of higher prices. - Scenario-Based Planning

Develop multiple contingency plans for varying tariff scenarios. Focus on profitability under worst-case conditions while maintaining agility for rapid adaptation.

Also Read: The Impact of Tariffs on Retail Pricing Strategy in 2025

How Impact Analytics Can Help

At Impact Analytics, we offer solutions tailored to help retailers navigate the challenges of tariffs:

- Negotiating with Manufacturers: Negotiations with vendors will start on day one. It will be important for merchants to know where to negotiate and which SKUs to target for a hard bargain.

- Granular Elasticity Analysis: Identify tariff-impacted Key Value Categories (KVCs) and Key Value Items (KVIs) to prioritize critical adjustments with precision.

- SKU- and Category-Level Pricing Adjustments: Implement data-driven recommendations on where to absorb costs and where to pass them along, factoring in historical inflationary trends.

- Demand Shift Simulations: Leverage advanced AI models to forecast consumer behavior and develop smarter tactics, such as targeted promotions and bundles, to retain revenue and customer loyalty.

- Continuous Optimization: Collaborate with your team to establish a “Test & Learn” framework, ensuring adaptability in an ever-changing market.

- Competitor Benchmarking: Align pricing strategies with market dynamics to maintain competitiveness while driving profitability.

Conclusion

Tariffs aren’t just another policy shift—they’re a potential economic earthquake for the retail industry. The lessons from 2018–2019 are clear: tariffs disproportionately hurt businesses and consumers. With inflationary pressures and weakened consumer spending, the stakes are higher than ever.

Retailers who understand the nuances of elasticity, embrace predictive analytics, and invest in diverse supply chains will not only survive but thrive. This is your opportunity to rewrite the playbook, taking lessons from past missteps and using them as stepping stones to long-term resilience.

At Impact Analytics, we’re more than ready to help you tackle this challenge head-on. Together, we can turn disruption into opportunity. The question isn’t whether you can adapt—it’s how soon you’ll start.

Contact Impact Analytics today to learn how we can help you prepare for this new era of tariffs.