Josh Pollack

Josh Pollack

VP, Implementation and Business Development

Even if you’re a seasoned retailer well-steeped in retail analytics, it’s instructive to review the retail pricing basics every now and again

Why is Retail Pricing Important?

Very few merchandising decisions have as sweeping an impact on business performance as the pricing of items in your product assortment.

Obviously, pricing immediately and directly affects revenues. Every incremental penny a retailer can charge for an item accrues to the bottom line. Advanced pricing software tools enable you to improve competitive pricing while simultaneously improving overall profitability.

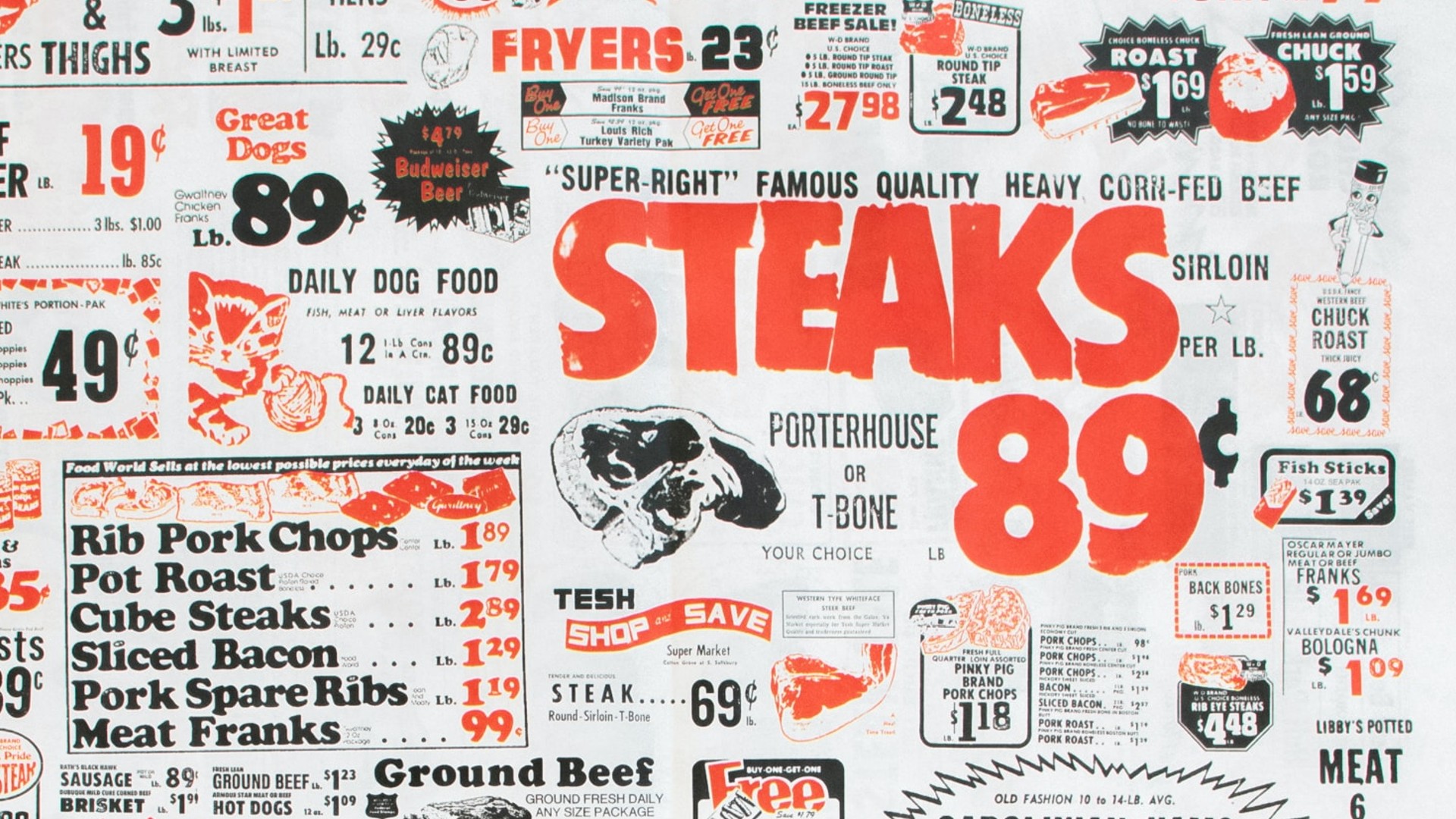

Additionally, properly set pricing forcefully conveys both your retail brand positioning and value proposition. Pricing approaches differ significantly between dissimilar products, such as short-run designer garments (where a higher price might add to the cachet) versus everyday pantry items, such as eggs. These benefits are hard to ignore, especially when your rivals employ sophisticated pricing tools and methods.

What are the Best Ways to Calculate Retail Pricing?

There are at least four main methods for calculating product prices with a lot of nuance applied after the fact. These methods are best combined through sophisticated processes and automated via price optimization software.

Retail Pricing Calculator: Based on Gross Margin

The easiest way to determine retail product prices is to apply a gross profit target to each item and add that expected profit to the cost. For example, if a tub of butter costs you $2.62 and you’ve set a 14 percent profit, then set the retail price at $2.99 ($2.62 cost + $0.37 or 14 percent profit = $2.99). Profit targets can be set for an entire range or for a particular category.

Retail Pricing Calculator: Based on Competitor Price

Retailers may also want to take into account the prices at which their competitors are offering similar or identical items. Here, as mentioned above, the company’s brand positioning and value proposition may determine the pricing strategy; for example, luxury retailers may charge a premium for the cachet, ambiance, and service they offer. Value-based retailers, on the other hand, should closely monitor competitor prices and respond aggressively to price moves, at least for the relevant subset of products.

Retail Pricing Calculator: Based on Elasticity

Elasticity gauges your customers’ response to price changes and is typically measured by analyzing the prices and sales quantities of past transactions, then comparing the changes in price to changes in unit sales. These measures reveal how items within a product range can have very different selling behaviors when prices are raised or lowered. Customers usually have clear reference prices (preconceptions about the price) for items they purchase frequently, such as milk or fruit. But for items that feature proprietary technology, a unique design, or are simply bought infrequently, customers allow retailers much more pricing latitude.

By identifying each item’s degree of elasticity and setting prices accordingly, retailers can boost profits and improve their price image. For example, the money you invest in lowering prices on elastic goods may be more than offset by subtly raising prices on items that are not price sensitive.

Retail Pricing Calculator: Based on Cross-Product Relationship

Many items are best priced similarly to other items in the same range, such as different flavors of the same size and brand of yogurt or cat food. Alternatively, items can be placed in a tiered-price relationship in which one item is always priced higher, or lower, than a comparable item in the range—consider organic chicken breasts, which are nearly always priced higher than conventionally produced chicken, or private-label cola priced lower than Coca-Cola.

Retail Pricing Strategies: How to Evaluate Success

There are several basic lenses through which to view your retail pricing strategy success.

Retail Pricing Strategy Success: Time Comparison

Perhaps the simplest way to determine the success of different pricing strategies is to review key business metrics—sales turnover, unit sales, profit amount, profit percent, competitor price index—before and after pricing changes. If these metrics improve, the price change was likely well received by your customers. But you’ll need to consider a lot of factors beyond your pricing action that may impact those measures.

Retail Pricing Strategy Success: Selling Location Comparison

To more accurately measure the success of different pricing strategies, you’ll need to conduct controlled tests. One method entails selecting a group of similar stores and changing the prices in a subset while leaving the others alone. The difference between the performance in the changed and non-changed items is likely due to the pricing activity.

Retail Pricing Strategy Success: Similar Product Comparison

An even more sophisticated method for measuring price strategies, useful especially when a location comparison is inappropriate, is to measure the performance between items in the range. To do this effectively, you’ll need to use statistical methods that compare the selling patterns of the changed items to all the remaining items in the range. This analysis identifies items, or groups of items, that have sold in similar patterns over time. Comparing the financial performance of static items to the price-changed items will determine the pricing activity’s impact.

Take the Next Step

Getting retail pricing right is critical but complicated. Not surprisingly, we recommend you consider partnering with us to develop the exact pricing solution you need.

AI-powered Impact Analytics PriceSmart™ drives informed, intelligent decisions on initial, promotional, markdown, and clearance pricing, enabling you to achieve your business objectives and grow profitability.