Automated Pricing Decisions with PriceSmart

Have full confidence with every pricing adjustment. PriceSmart is your dynamic and adaptive pricing expert, leading the charge on data-backed decisions that support your business goals.

Contact UsTrusted by Market-Leading Global Brands

Your Lifecycle Pricing Solution

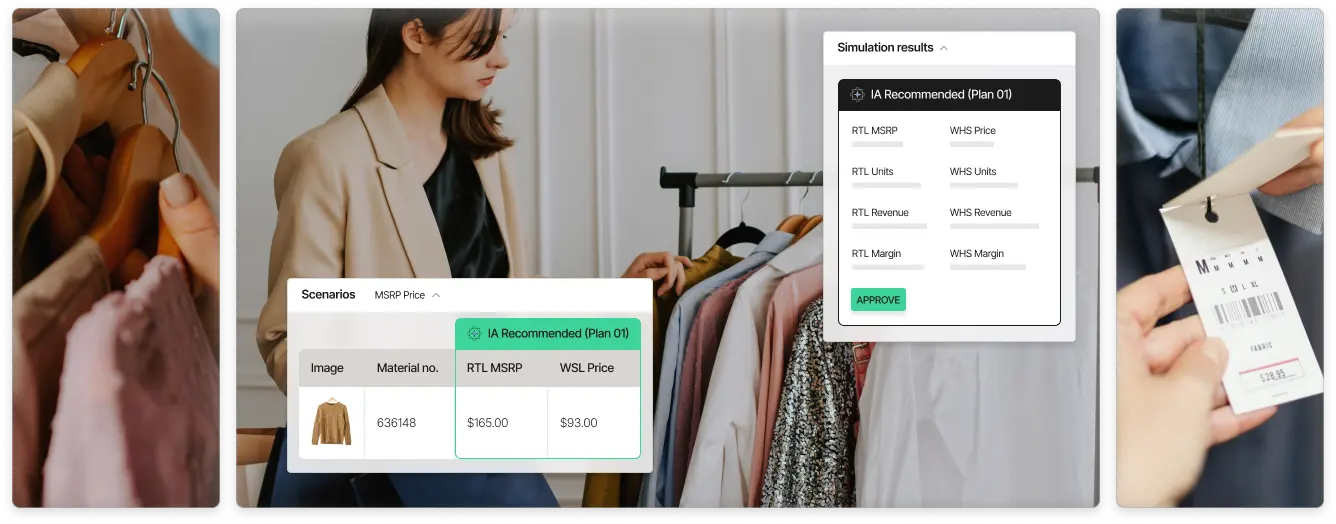

Pricing guesswork is a thing of the past with PriceSmart. This AI pricing software fully integrates across your company’s systems and departments for accurate pricing, promotion, and markdown decisions.

The Key to Unlocking

Pricing Complexity

Success in pricing creates success across your entire product lifecycle. PriceSmart keeps your company one step ahead with automated decision-making informed by business goals.

Pricing Solutions

for Every Industry

PriceSmart ensures accurate pricing across every part of the product lifecycle, because data-driven adaptability is crucial for ever-evolving markets.

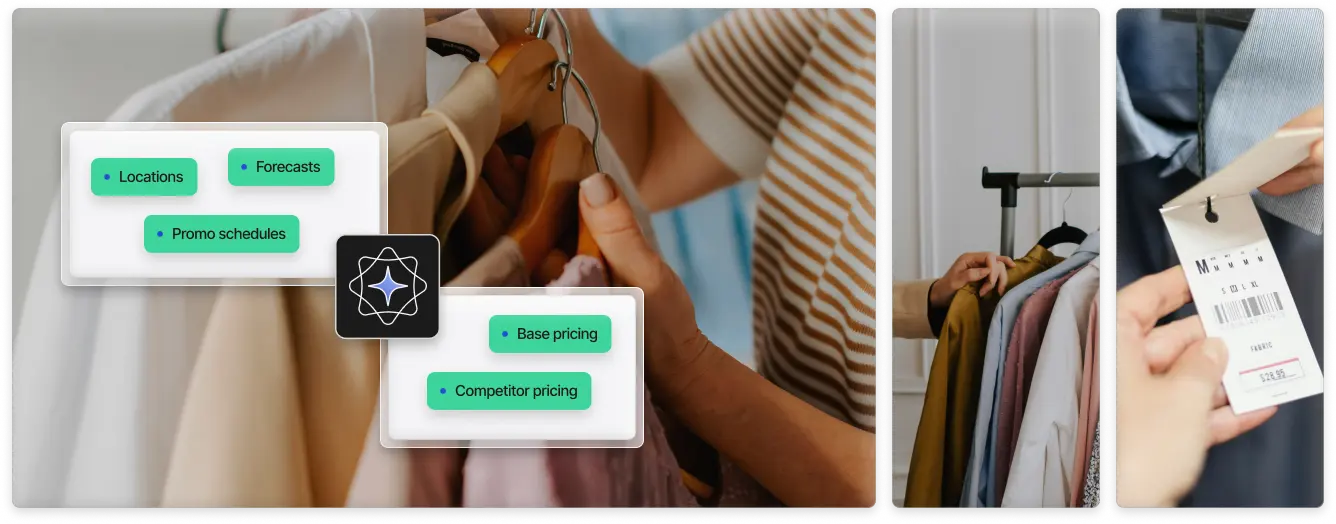

HOW IT WORKS

The Path to Seamless PriceSmart Integration

Ready for total pricing strategy peace of mind?

See how PriceSmart is increasing productivity and revenue success for industry leaders.

Pricing Success

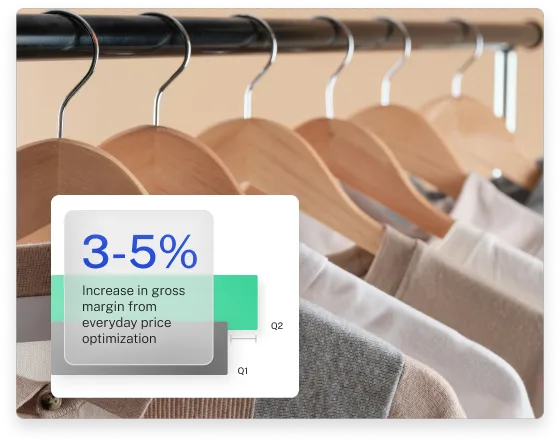

for Retailers

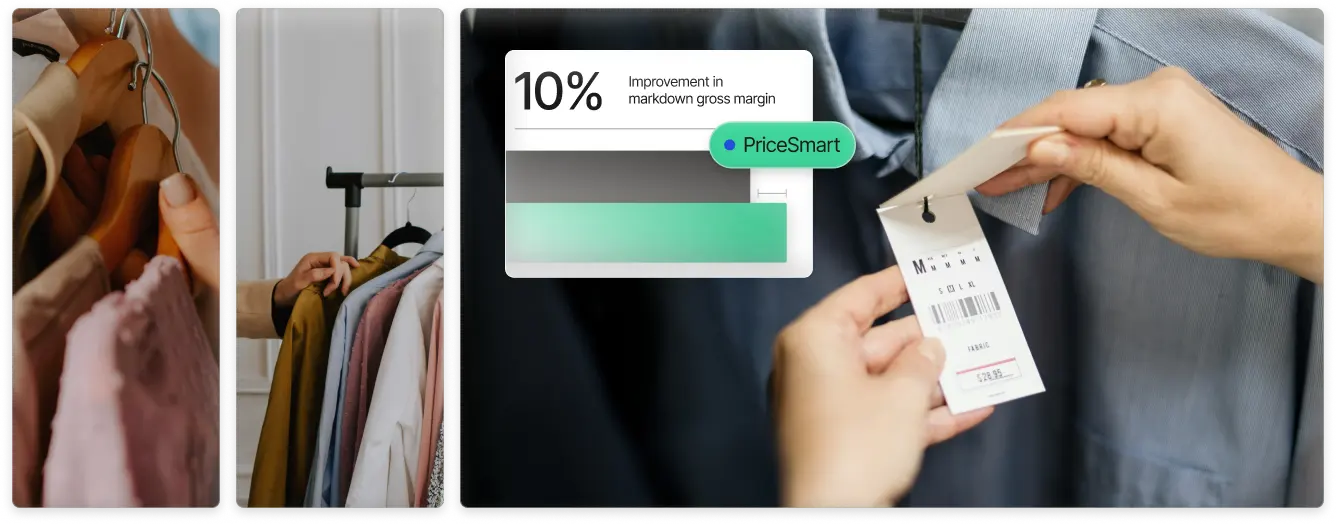

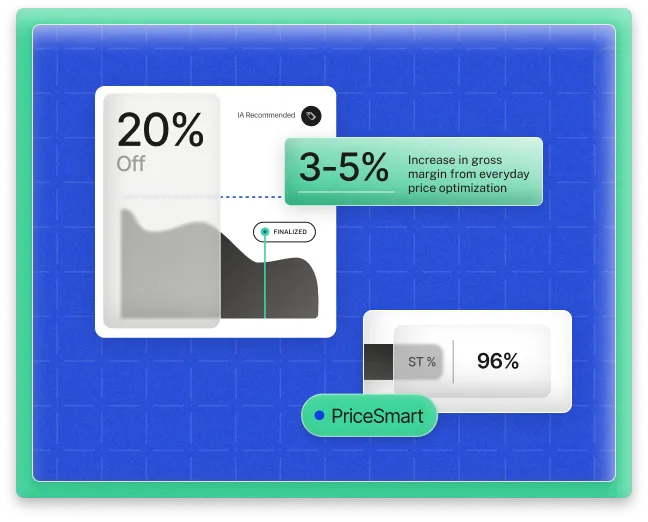

PriceSmart is more than a convenient tool. It's a crucial partner for decision-making in make-or-break pricing moments—and we have the results to prove it.

Increase in gross margin from everyday price optimization

Incremental ROI on margin-accretive promo spend

Improvement in markdown gross margin